The government has in recent times turned down billions of Ghana Cedis in investor bids through its Treasury bill auctions.Ghanaian travel experiences

In its last auction, it rejected GHS8.27 billion – one of the highest since March 2023.

This comes after the government in an earlier auction held on February 7, 2025, rejected GH₵2.9 billion in treasury bill bids following a highly oversubscribed auction.

Another recent and interesting feature in Ghana’s Treasury market is that since the start of 2025, interest rates in the treasury market have been on a steady decline.

But why is this happening? Is the government trying to cut borrowing costs, or is there a deeper issue at play?

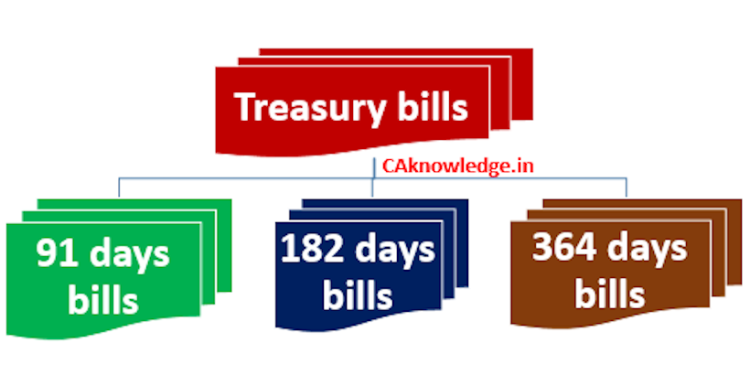

What are Treasury Bills?

Treasury bills also known as T-bills are short-term government securities issued to raise money for public spending. They are a crucial part of government financing and influence interest rates across the economy. Here, investors lend money to the government by buying T-bills, and in return, they receive their principal plus interest after a set period of 91, 182, or 364 days.

So typically, one can say, T-Bill issuances are not meant to finance long term projects. They are supposed to be for liquidity management. Maybe when government falls short of funds or revenue performance hasn’t been great but they have bills to pay.

T-bills is more like a stock gap measure to level up one’s liquidities when there are shortfalls. It is not necessarily meant to be a main funding source to fund long term obligations.

It is important to mention that Treasury bills are one type of treasury instrument that the government uses to raise funds. Other treasury instruments include Treasury notes, and Treasury bonds, all of which serve as debt instruments issued by the government.

While T-Bills continue to see strong demand, government bonds and notes have faced defaults, eroding investor confidence in longer-term debt instruments.

How Treasury Bill Auctions Work

The auction process which government, through the Bank of Ghana (BoG), holds regularly, usually weekly, follows these steps:Ghanaian travel experiences

Step 1

Government through the BoG announces an auction date, target amount, and bill durations (91-day, 182-day, 364-day, etc.)

Then investors (banks, pension funds, individuals) decide how much they want to invest and at what interest rate.

Step 2

Investors then submit bids, stating the amount they are willing to invest and the interest rate also known as the yield they expect.

Note that there are two types of bids:

• Competitive Bids – Here, investors specify an interest rate. If their rate is too high, their bid might be rejected.

• Non-Competitive Bids: Investors accept whatever rate the government sets, guaranteeing allocation.

Step 3

Government Accepts or Rejects Bids – Here, the BoG reviews all bids and determines how much to accept based on the interest rates. If investors demand high rates, the government may reject their bids to avoid borrowing at expensive rates. Could the situation we currently find ourselves in since the new government took office?

Another instance is that, the final accepted bids determine the cut-off interest rate for that auction.

Step 4: Settlement and Payment

• Investors whose bids are accepted pay the government the amount they bid.

• At the end of the T-bill’s term, investors receive their original investment plus interest.

Why is Government rejecting some bids?

1. To control interest rates and avoid excessive borrowing costs

Treasury bill auctions operate on a bidding system where investors propose the rates at which they are willing to lend to the government. If bids demand unreasonably high interest rates, the government may reject them to prevent unsustainable borrowing costs. Accepting high-interest bids would escalate debt servicing expenses, potentially triggering inflationary pressures and limiting resources for development projects.

2. To limit borrowing when funding needs are met

Governments set target amounts for each auction. When bids exceed what is required, authorities may accept only a portion, rejecting surplus bids. This disciplined approach ensures efficient public debt management, preventing unnecessary borrowing and minimising fiscal strain.

3. To signal confidence in securing lower rates in future auctions

By rejecting high-rate bids, the government may be indicating that it expects interest rates to decline. If investors interpret this as a sign of economic stability and sound fiscal management, they may be more inclined to offer lower rates in subsequent auctions. This strategy helps reduce long-term borrowing costs and sustains financial market stability.

Ultimately, a strong investor appetite for short-term government securities suggests ample liquidity in the market. Rejections indicate that the government has raised sufficient funds or is strategically influencing the yield curve by discouraging excessively high rates. Additionally, rejecting high-yield bids mitigates the crowding-out effect, allowing private sector borrowers to access capital at more favourable rates, fostering broader economic activity.

Why are yields declining despite oversubscriptions and rejections?

A look at treasury auction data from early 2025 reveals a steady decline in interest rates across all maturities. Between January 6 and February 17, the 91-day bill yield fell from 28.19% to 26.86%, the 182-day bill declined from 28.91% to 27.80%, and the 364-day bill eased from 30.15% to 29.07%.

1. Rising Investor Demand

Oversubscription reflects strong appetite for treasury bills, giving the government leverage to accept bids at lower rates. With defaults in bonds and notes pushing investors toward safer instruments, demand for T-bills remains high, facilitating a downward yield trend.

2. Government’s Borrowing Strategy

A deliberate policy of rejecting high-yield bids while accepting lower ones exerts downward pressure on overall yields, reinforcing the strategy of reducing borrowing costs.

3. Improved Macroeconomic Indicators

Optimism surrounding the new administration and potential fiscal reforms has bolstered investor confidence. A stable exchange rate, controlled inflation (which eased to 23.5% in January from 23.8% in December), and signs of economic stability encourage investors to accept lower yields, reflecting expectations of reduced risk.

What should Government do to maintain the trend, and what should investors expect?

To maintain the current downward trend in yields, market analysts note that the government should continue its prudent strategy of rejecting higher bids while maintaining clear communication regarding future borrowing needs and fiscal health.

In the short term, maintaining fiscal discipline and ensuring borrowing remains within sustainable limits will be key. In due time transparent monetary policies, moderate money demand and continued macroeconomic stability are expected to sustain lower yields.

Over the long term, structural reforms to strengthen the economy, enhance debt sustainability, and deepen capital markets will be key to balancing liquidity needs while keeping borrowing costs in check. Investors can expect a stable but cautious approach, as confidence builds in improved economic indicators over the next few quarters, but they should remain vigilant as external factors could influence market conditions.

Conclusion

The declining yield trend underscores strong liquidity in the market and investor confidence in government securities. Strategic bid rejections serve as a tool for managing interest rates, reducing debt costs, and creating space for private sector financing.

Moving forward, the government’s ability to sustain fiscal discipline and implement prudent policies will determine the long-term trajectory of borrowing costs and market stability.